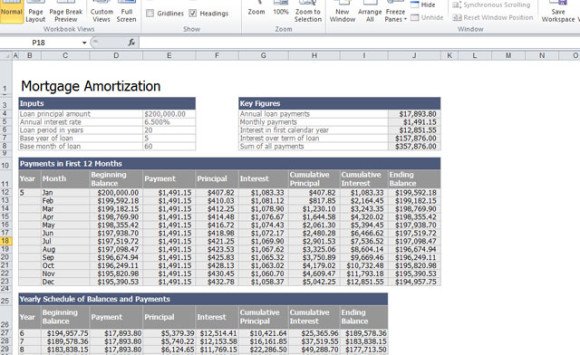

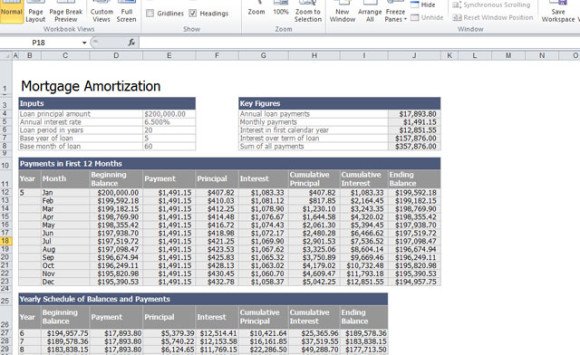

Add in taxes, insurance and homeowners association (HOA) fees. If, instead, you want a balance between low monthly payments and a shorter term, you can use this portion of the calculator to compare your options. For example, if you choose a 15-year term, use the average rate for a 15-year mortgage. If you haven’t been approved for a loan term and interest rate, the rate you select here should correspond with the average rate you entered above. To help calculate your monthly mortgage payment, enter a loan term up to a maximum of 30 years. If you haven’t prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point. If you’ve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. Next, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount. And if you’re considering making an offer on a home, this calculator can help you determine how much you can afford to offer.

If you don’t have a specific house in mind, you can experiment with this number to see how much house you can afford. Start by adding the total purchase price for the home you’re seeking to buy on the left side of the screen. Whether you’re shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments.įollow these steps to use the Forbes Advisor mortgage calculator:

Mobile home mortgage calculator how to#

How to Calculate Mortgage Payments Using Our Calculator

0 kommentar(er)

0 kommentar(er)